FINANCIAL CLARITY

Spend time enjoying what you love most knowing you have financial clarity.

PEACE OF MIND

Know that your finances and loved ones are taken care of.

PROACTIVE

Always looking out for your best interests with independent unbiased advice.

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

Can you afford retirement?

Looking forward to a relaxing and enjoyable retirement but unsure how much you can afford to spend each year without running out of money? Perhaps you’ve already talked to your advisor or financial institution about your concerns, but you don’t feel like you’re getting the answers you need from them.

If this sounds like you, then the retirement income planning that Mercator Financial can offer you is what you’re looking for may be just the service you’re looking for! With Mercator Financial and our financial retirement planning, you get a detailed retirement income plan from an unbiased professional – so all you have to do is relax and enjoy your retirement!

- How much income you’ll need during your retirement years.

- How to withdraw your income in a tax-efficient manner.

- What the best investment strategies are for you.

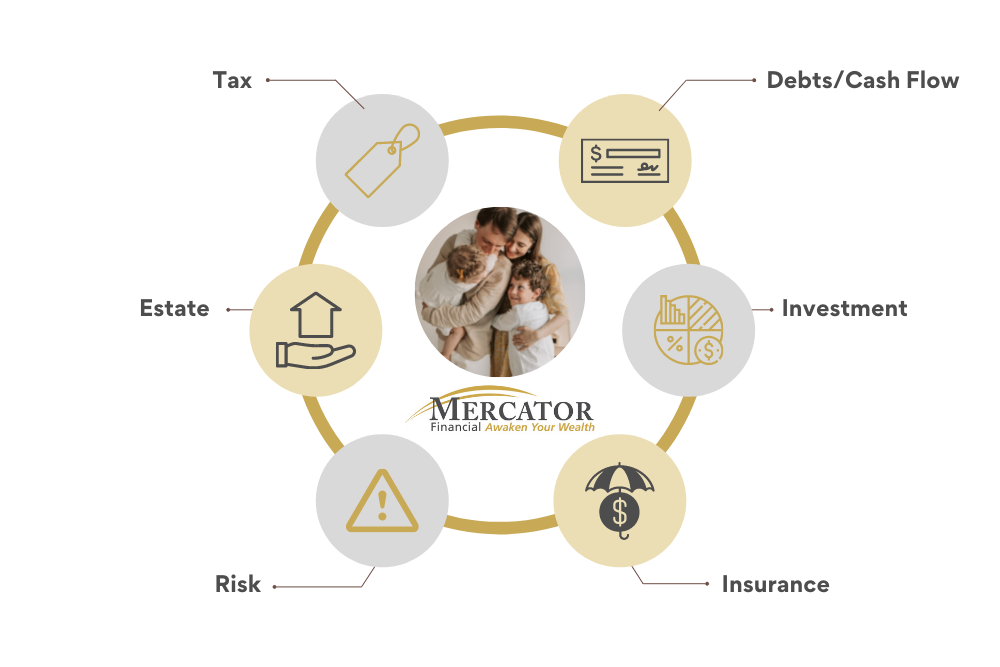

Are your Finances Organized?

Would it be valuable to get organized in all 7 areas?

- Tax

- Estate

- Risk

- Investments

- Insurance

- Debts/Cash Flow

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

We can get your Finances in Order

It’s essential to approach your retirement years feeling secure in your finances. During our planning process, we’ll discuss with you:

- How to spend sustainably during retirement.

- The amount of savings you’ll need to have in conservative, easy-to-access investments.

- How to draw an income in a tax-efficient manner.

- How to coordinate all your sources of income – both from business (e.g., stock options or retirement allowances) and personal (e.g., RRSPs, TFSAs, and CPP) sources.

- What types of insurance you’ll need, such as health, travel and life insurance.

- Estate planning.

Our goal is to make sure you retire with a solid financial plan in place. In addition, we’ll work to ensure you don’t miss out on any time-sensitive opportunities and may enjoy your ideal lifestyle – whether that’s going somewhere warm every winter or just having more time to spend with friends and family!

Would it be valuable to get clarity around your goals for the future and put it on paper?

Your Retirement Plan

With your own personalized Retirement Plan, you’ll have a consolidated summary of your entire financial life with step-by-step support at your fingertips. A Retirement Plan for retirees is key to keeping you informed, engage, and motivated about your financial future!

For illustration purposes only, intended for Mercator Financial Inc. clients.

Getting Started With Retirement Planning

You’ve worked hard, and you want to spend your retirement years living a fulfilling life and achieving your goals. So now’s the time to focus on your dreams – whether that’s travel, volunteering, or opening your own business.

So what we need you to do before you come to us and think about these three things:

- First, what matters most to you?

- Second, what are your retirement goals?

- Third, what are your most cherished values?

Once you know the answers to these questions, we can help you plan for your dream retirement!

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

Do you have Financial Clarity?

Ready to get started?

If you like the sound of what you’ve read so far, then the next step is to book a meeting with us. During the planning process, you’ll have a total of three meetings.

Discovery Meeting

During our first meeting, we’ll lay out your financial road map. We’ll discuss:

- How you picture your retirement. We want to know your goals and values – what’s important to you during your retirement years.

- Your current financial position. We’ll look at the current state of your finances and talk to you about what kind of steps you’ll need to take to reach your goals.

Ready to get started? Book a meeting with us now. We’ll let you know ahead of time any questions you need to answer and what kind of financial paperwork to bring with you.

Your Customized Financial Road Map

One week following our initial meeting, we will arrange a follow-up appointment to delve into your proposed retirement plan. During this session, we will address your most pressing questions, covering topics such as:

- What types of reliable income, such as CPP and OAS, can you anticipate throughout your retirement years.

- The optimal approach for withdrawing funds to minimize your tax liability.

- Detailing the structure of your portfolio and exploring the potential rate of return required to achieve your desired income flow.

- Determining the essential insurance coverage for your needs, including life, health, and travel insurance.

- Determine the nature of the estate you will be leaving behind.

We’ll walk you through all the steps you’ll need to take to implement your retirement income plan.

Implementation Meeting

A few weeks after meeting number 2, we’ll meet with you again to get your feedback on our suggestions, adjust as necessary, and put together a final draft of your plan. Once all of this is done, we’ll be ready to put your plan into action!

At this stage, you can let us know if you’d like to delegate any of the responsibilities of implementing your plan to us. You can do this by selecting to continue working with us and taking advantage of our full-service investment management and tax planning services.

Schedule an appointment with us today!

Download “5 Retirement

Mistakes to Avoid”

* indicates required